TelexFree Trustee Files Detailed Financial Reports, Previews Next Steps

As the one-year anniversary approaches of what may likely be the largest Ponzi and pyramid scheme in history based on the sheer amount of victims, the court-appointed bankruptcy has filed the long-awaited disclosures detailing the scheme's assets, liabilities, and financial affairs. Stephen B. Darr was appointed as trustee over TelexFree, Inc., TelexFree, LLC, and TelexFree Financial, Inc. (collectively, "TelexFree") shortly after state and federal authorities alleged that the purported internet telephony company was nothing more than a massive Ponzi and pyramid scheme that may have defrauded countless victims worldwide out of hundreds of millions of dollars. On Friday, Darr filed TelexFree's (1) Statement of Financial Affairs; and (2) Schedule of Assets and Liabilities (collectively, the "Filings"). The filings, required by debtors at the onset of a bankruptcy proceeding, are useful in providing a general overview of TelexFree's financial status and what might possibly be available for defrauded victims at a future date.

As the one-year anniversary approaches of what may likely be the largest Ponzi and pyramid scheme in history based on the sheer amount of victims, the court-appointed bankruptcy has filed the long-awaited disclosures detailing the scheme's assets, liabilities, and financial affairs. Stephen B. Darr was appointed as trustee over TelexFree, Inc., TelexFree, LLC, and TelexFree Financial, Inc. (collectively, "TelexFree") shortly after state and federal authorities alleged that the purported internet telephony company was nothing more than a massive Ponzi and pyramid scheme that may have defrauded countless victims worldwide out of hundreds of millions of dollars. On Friday, Darr filed TelexFree's (1) Statement of Financial Affairs; and (2) Schedule of Assets and Liabilities (collectively, the "Filings"). The filings, required by debtors at the onset of a bankruptcy proceeding, are useful in providing a general overview of TelexFree's financial status and what might possibly be available for defrauded victims at a future date.

History

Before delving into a brief analysis of the Filings, a brief history of TelexFree is beneficial for context. Prior to April 2014, the company purportedly offered a voice over internet protocol (“VoIP”) program and a separate passive income program. The latter was TelexFree's primary business, and offering annual returns exceeding 200% through the purchase of "advertisement kits" and "VoIP programs" for various investment amounts. Not surprisingly, these large returns attracted hundreds of thousands of investors worldwide, and participants were handsomely compensated for recruiting new investors – including as much as $100 per participant and eligibility for revenue sharing bonuses. Ultimately, while the sale of the VoIP program brought in negligible revenue, TelexFree's obligations to its "promoters" quickly skyrocketed to over $1 billion.

In April 2014, after multiple attempts to modify the passive income program both to rectify regulatory deficiencies and to curb increasing obligations, TelexFree quietly filed for bankruptcy in a Nevada bankruptcy court. While it appeared that TelexFree had hoped to use the bankruptcy proceeding to eliminate its obligations to its "promoters" and extinguish any ensuing liabilities, the filing immediately attracted scrutiny and was followed shortly by enforcement actions filed by the Securities and Exchange Commission (the "Commission") and Massachusetts regulators. The Commission then moved to transfer the bankruptcy proceeding to Massachusetts, where the company was headquartered and where the Commission had filed its enforcement proceeding. Despite vehement objections by TelexFree, that effort was ultimately successful, and the appointment of an independent trustee, Mr. Darr, shortly followed.

Following his appointment, Mr. Darr and his team have faced the monumental task of reconstructing TelexFree's voluminous records and attempting to gain an understanding of a massive alleged fraud whose tentacles spanned the globe. At Mr. Darr's request, the proof of claim deadline was indefinitely postponed pending his efforts, and a recent update by Mr. Darr speculated that any claims process would likely include hundreds of thousands - if not millions - of claimants.

The Filings - Statement of Financial Affairs

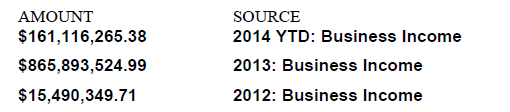

The Statement of Financial Affairs ("Statement") serves to provide the Court, as well as interested parties, a snapshot of the bankruptcy debtor's financial health and recent history preceding the date of the bankruptcy filing (the "Petition Date"). One of the required disclosures is the amount of income earned by the debtor in the two-year period preceding the Petition Date. Of note, the Statement shows that TelexFree took in over $1 billion during that period:

As authorities previously estimated that the sale of TelexFree's VoIP program ultimately brought in no more than $2 million, the vast majority of the over-$1 billion is believed to be comprised of investor contributions.

Another required disclosure lists the names of all individuals and entities that received transfers of property exceeding $600 in the 90-day period preceding the Petition Date. This time frame is not arbitrary, but rather derives from the power given to bankruptcy trustees to seek the avoidance of what are called "preferential transfers" made during that period in which the debtor is presumed to be insolvent. With limited defenses available to recipients, these transfers are typically subject to heightened scrutiny by the bankruptcy trustee. The Statement lists over 100 of these transfers, including over $1 million in payments to law firms and/or multi-level marketing consultants:

- Greenberg Traurig - $624,823;

- Garvey Schubert Barer - $532,503.50;

- Babener & Associates (self-described multi-level marketing law firm) - $283,000;

- Lane Powell Attorneys & Counselors - $27,381.70; and

- The Sheffield Group - $34,400.

Also of note are numerous payments to Craft Financial Solutions, LLC, an entity owned by former TelexFree CFO Joseph Craft. As some may recall, authorities recovered nearly $40 million in newly-issued cashier's checks on Craft's person as he attempted to retrieve his belongings from the TelexFree office while authorities were executing a search warrant. The Statement lists dozens of transfers to CFS totaling over $2 million during the one-year period preceding the bankruptcy (as Craft was an insider), including a $1 million transfer in December 2013. Craft, who was among those charged with fraud by the Commission, has maintained he was unaware of any fraud being carried out by TelexFree.

The Filings - Schedule of Assets and Liabilities

The Schedule of Assets and Liabilities ("Schedule"), as its title suggests, sets forth information on TelexFree's assets and liabilities. The Schedule lists over $150 million currently held in a variety of bank accounts belonging to TelexFree, as well as over $15 million in debts currently owed to TelexFree. In terms of liabilities, no secured claims are listed, but several entities are said to hold unsecured claims with a priority status - including nearly $20 million purportedly owing to the Internal Revenue Service. Creditors with a secured claim or an unsecured claim with priority status are typically entitled to have their claims paid in full before those creditors with wholly unsecured claims - including fraud victims - may receive distributions. Ultimately, the bankruptcy court will determine whether to approve or reject any proposed distribution plan offered by the trustee.

The Schedule also includes a 2,000+ page schedule setting forth a partial list of participants in TelexFree, including those who submitted a proof of claim form to the claims consultant retained by Mr. Darr, Kurtzman Carson Consultants ("KCC"). In a recent status report, Mr. Darr disclosed that over 25,000 participants had already filed a proof of claim form despite the lack of a current claims deadline. Mr. Darr disclosed that his team had identified nearly 1.9 million participants in TelexFree - a list that, if printed, would fill over 35,000 pages. Mr. Darr indicated that he intended to request court approval to establish a bar date for the submission of claims, which he hopes may be done through electronic notice to the participants. For example, postage alone on 1.9 million pieces of U.S. Mail would exceed $750,000.

Those interested in filing a Proof of Claim with KCC may do so here.