Former Model Pleads Guilty To $7 Million Construction Ponzi Scheme

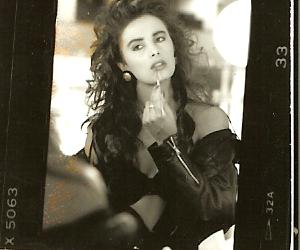

A single mother and former model agreed to plead guilty to charges that her promises to double investors' money through financing construction projects was, in reality, nothing more than an elaborate Ponzi scheme. Tina Louise Mangiardi, pictured below in her former days as a model, will plead guilty to one count of mail fraud and one count of wire fraud in a plea agreement reached with federal prosecutors in Orlando, Florida. Both mail fraud and wire fraud carry maximum terms of up to twenty years in federal prison, as well as criminal monetary penalties. However, under federal sentencing guidelines, Mangiardi will likely face a much lighter term.

Mangiardi, a former model and single mother, was the principal of two Orlando businesses, T.L.M. Builders & Design, LLC, and Tlm Design and Construction, Inc. Beginning in or around 2008, Mangiardi began pitching potential investors to invest in "bid bonds" for various Orlando-area projects, including restaurant chains, local hospitals, and even Disney. A bid bond, which is not considered investment grade, are used to guarantee the financial viability and amount of a bid given by a construction company, and are typically issued by insurers. In return for this authentication, the contractor usually must pay a small fee to the insurance company. Mangiardi explained that she could double or triple investors' money within weeks, and lured investors by stressing her strong Christian faith and explaining that her gender would allow her to qualify as a minority in bidding for government contracts.

Based on these promises, Mangiardi raised millions of dollars from at least 40 Orlando-area victims. Many of these victims, according to authorities, were male business associates.

However, complaints soon began mounting when scheduled payments fell behind, and at one point the U.S. Secret Service began an investigation. Court records show at lest eight lawsuits against Mangiardi and her companies since 2010, with $1.4 million in judgments obtained to date. This week Mangiardi confirmed those suspicions by admitting that, rather than obtaining lucrative gains by financing bid bonds, Mangiardi was operating a classic Ponzi scheme using funds from new investors to fund payments to older investors. Interestingly, before pleading guilty, Mangiardi had a series of exchanges with The Ledger, a Lakeland, FL area newspaper, in which she maintained her innocence, blasted those who had sought repayment of their loans, and even maintained that she was in possession of agreements that provided that any investor "talking or defaming me and my company causes instant void of payment plans and forfeit of payments."

A sentencing date has not yet been set.