'Restructuring' of Popular Online Gold Investment Venture Raises Eyebrows

An ominous announcement that a popular online gold investment company would be 'restructuring' its operations and suspending monthly 10% dividend payments has caused discontent among many of its investors and has many questioning the legitimacy of the company. Virgin Gold Mining Corporation ("VGMC"), which purports to engage in gold mining operations worldwide, has gained an almost cult-like following due to its steady stream of monthly dividends paid in ounces of gold. However, in an announcement earlier this week, the company announced that it would be suspending dividends, restructuring the company, absorbing "losses" in the gold program, and switching to a platinum investment program. Additionally, gold fund investors would have their shares transferred into a closed-end fund that, if they disagreed, would not be able to request a "voluntary asset distribution" until the end of 2013.

In a lengthy press release on October 1st, 2012, which has since been removed and is inaccessible (a copy was obtained by Ponzitracker and is available here), VGMC outlined a lengthy process in which it would transfer its operations from Panama, where it was currently situated, to the British Virgin Islands ("BVI"). The company's offering of convertible preferred shares in gold, known as CPS-GOLD, would cease, and all gold mining assets would be transferred into a professional closed-end fund ("PCEF") housed in the BVI. According to VGMC, this change is being undertaken to create public transparency and allow the company to seek listing on a financial exchange within 12-15 months.

While shareholders were informed that their monthly dividends would be suspended, VGMC attempted to placate those investors by promising that the PCEF would be listed on a financial exchange by the end of 2012 at a price "of not less than USD10 per share" - an increase of 500% between now and the anticipated listing date. To those shareholders who disagreed, VGMC stated it was "unable to offer any alternatives," and again stated that it expected "shares in PCEF to increase five (5) fold within the next 12-15 months." Despite the obvious inability to predict the movement of gold prices, the company apparently is quite confident that the value of its assets will increase five-fold over the next year.

The October 1st press release comes on the heels of an earlier September press release informing investors that due to the implementation of a "monthly credit withdrawal policy", investors could only make redemption requests on the first day of every calendar month. Additionally, the implementation of a "beneficiary bank registration" meant that many redemption requests made in early September would not be able to be processed. In essence, the October 1st announcement marked the second month in a row that investors were not able to make redemption requests.

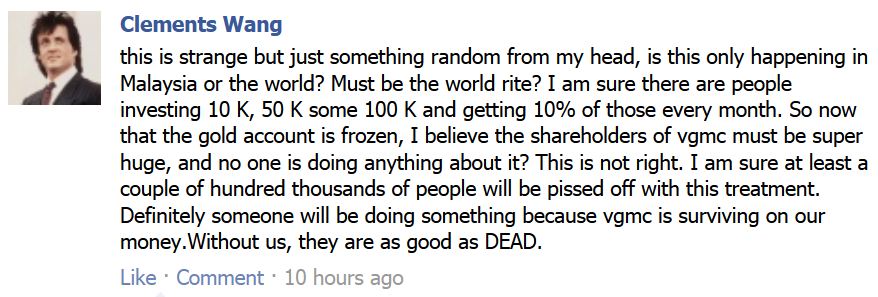

Despite the declaration by the Malaysian and Panamanian governments that VGMC was not authorized to sell securities, many elected to invest in VGMC due to its supposedly-dependable stream of monthly dividend payments. However, the decision to suspend monthly payments and prevent redemption requests until late-2013 has not gone over well with investors, as evidenced by several posts at various Facebook pages devoted to VGMC operations:

In the meantime, both VGMC's press release and its main website have become inaccessible as of earlier today. Investors must simply take a "wait-and-see" approach until VGMC provides further guidance.

A lively forum debate has emerged here at Panamaforum.com over the legitimacy of the scheme.